springfield mo sales tax calculator

Motor vehicle titling and registration Motor vehicle title penalties. 65801 65802 65803.

Real property tax on median home.

. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Avalara provides supported pre-built integration.

That means if you purchase a vehicle in Missouri you will have to pay a minimum of 4225 state sales tax on the vehicles purchase price. The current state sales tax on car purchases in Missouri is a flat rate of 4225. For additional information click on the links below.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. SalesUse Tax Bond Calculator. Real property tax on median home.

Mogov State of Missouri. Missouri has a 4225 statewide sales tax rate but also has 730 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3679 on. With local taxes the total sales tax rate is between 4225 and 10350.

The minimum combined 2022 sales tax rate for Springfield Missouri is. Missouri has recent rate changes Wed Jul 01 2020. There may be an additional local tax rate as well which can go as high as 6125 or as low as 05.

To calculate the sales tax amount for all other values use our sales tax calculator above. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The Missouri sales tax rate is currently.

S Missouri State Sales Tax Rate 423 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the Springfield Sales Tax Calculator or compare Sales Tax between different locations within Missouri using the Missouri State Sales Tax Comparison Calculator. Select the Missouri city from the list of cities starting with S below to see its current sales tax rate. Sales Tax State Local Sales Tax on Food.

Springfield in Illinois has a tax rate of 85 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Springfield totaling 225. The average sales tax rate in Colorado is 6078. Find Sales and Use Tax Rates Enter your street address and city or zip code to view the sales and use tax rate information for your address.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. Method to calculate Springfield sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Real property tax on median home. The Springfield sales tax rate is. Sales Tax Calculator in Springfield MO About Search Results Sort.

Indicates required field. You can print a 81 sales tax table here. Sales Tax State Local Sales Tax on Food.

Get rates tables What is the sales tax rate in Springfield Missouri. There is no applicable special tax. Sales Tax State Local Sales Tax on Food.

The County sales tax rate is. Missouri MO Sales Tax Rates by City S The state sales tax rate in Missouri is 4225. Additions to Tax and Interest Calculator.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Home Motor Vehicle Sales Tax Calculator The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date.

This is the total of state county and city sales tax rates. The Springfield Missouri Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Springfield Missouri in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Springfield Missouri. Enter zip codeof the sale location or the sales tax ratein percent Sales Tax Calculate By Tax Rateor calculate by zip code ZIP Code Calculate By ZIP Codeor manually enter sales tax Missouri QuickFacts.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 782 in Springfield Missouri.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. You pay tax on the sale price of the unit less any trade-in or rebate. Springfield MO Sales Tax Rate The current total local sales tax rate in Springfield MO is 8100.

All Zip Codes in Springfield Missouri 65801 65802 65803 65804 65805. Real property tax on median home. Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes.

The Springfield Sales Tax is collected by the merchant on all qualifying sales made within Springfield. Higher sales tax than 62 of Missouri localities 15 lower than the maximum sales tax in MO The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. 423 Missouri State Sales Tax 090 Maximum Local Sales Tax 513 Maximum Possible Sales Tax 781 Average Local State Sales Tax.

Copeland Accounting Tax Services Inc Tax Return Preparation Financial Services Accounting Services Directions 25 YEARS IN BUSINESS 8 YEARS WITH 417 887-9107 3128 E Sunshine St Springfield MO 65804 CLOSED NOW 2. Springfield is in the following zip codes. Did South Dakota v.

The December 2020 total local sales tax rate was also 8100. All numbers are rounded in the normal fashion. The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and a 213 city sales tax.

You can find more tax rates and allowances for Springfield and Illinois in the 2022 Illinois Tax Tables. Sales Tax Breakdown Springfield Details Springfield MO is in Greene County. Sales Tax State Local Sales Tax on Food.

Missouri Sales Tax Small Business Guide Truic

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Illinois Paycheck Calculator Smartasset

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Missouri Income Tax Rate And Brackets H R Block

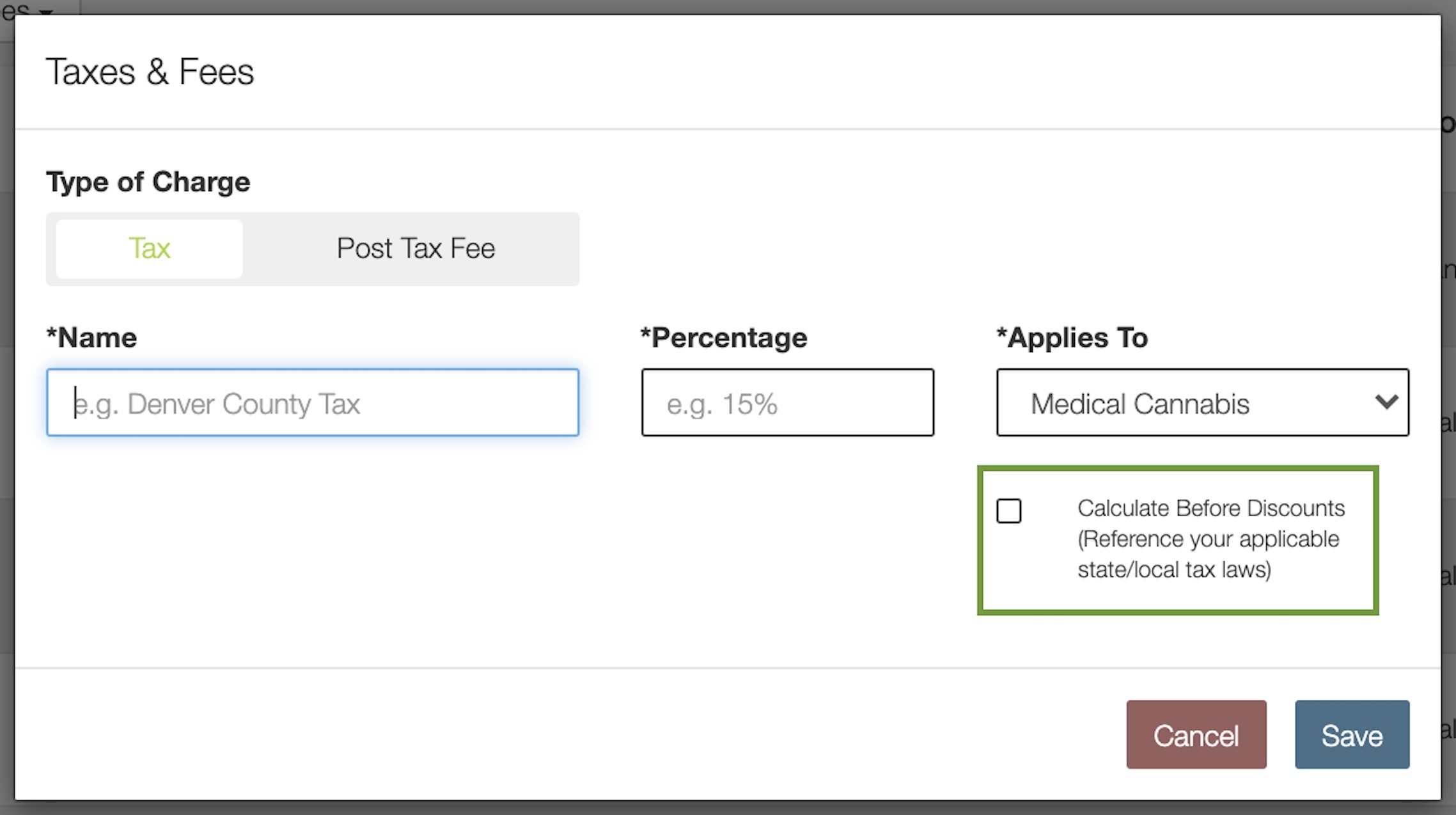

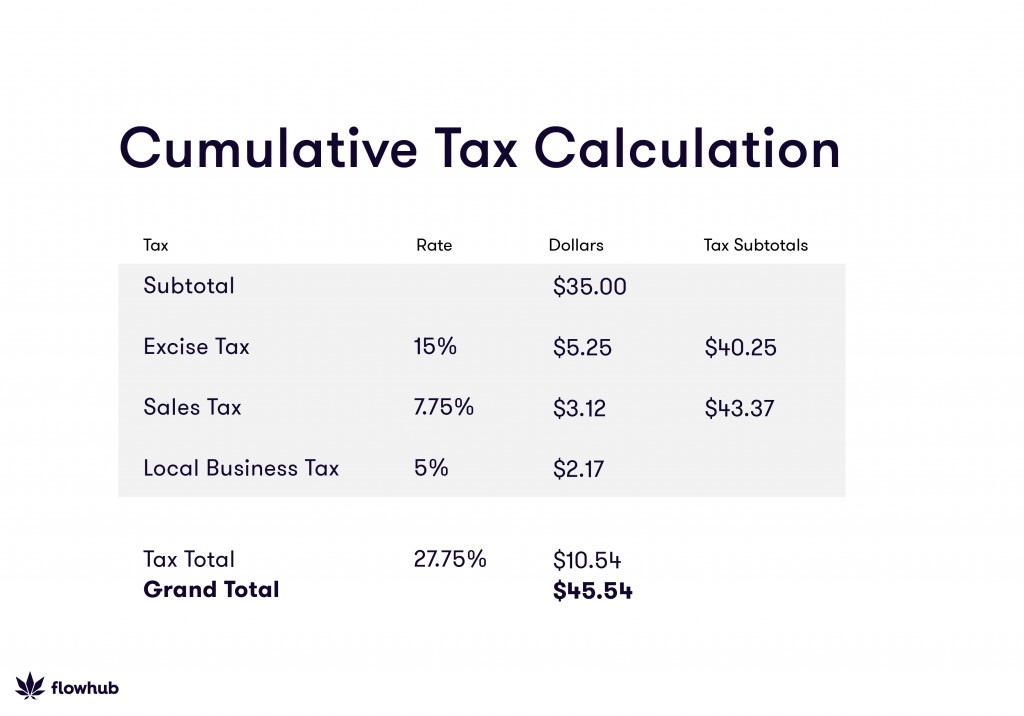

How To Calculate Cannabis Taxes At Your Dispensary

How To Calculate Cannabis Taxes At Your Dispensary

Sales Tax On Grocery Items Taxjar

Level Property Tax Springfield Mo Official Website

How To Calculate Cannabis Taxes At Your Dispensary

Missouri Car Sales Tax Calculator

Sales Taxes In The United States Wikiwand

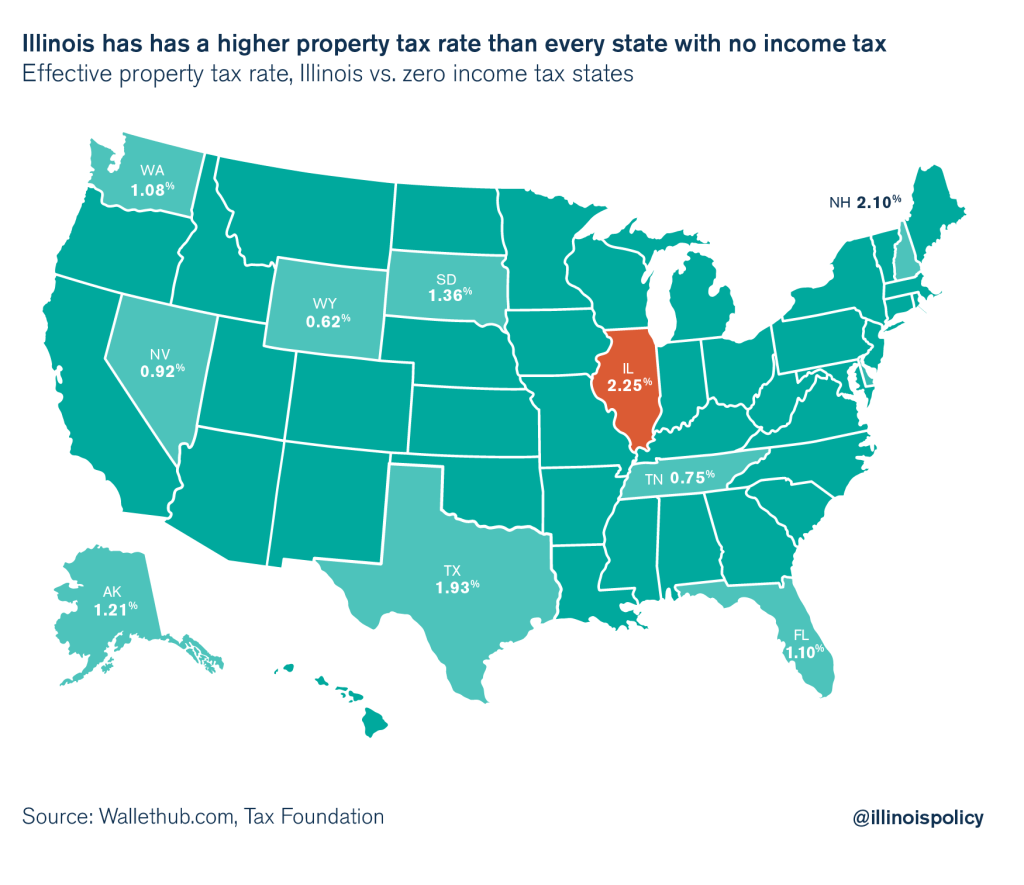

Illinois Has Higher Property Taxes Than Every State With No Income Tax